Real Estate Syndication

We offer exclusive commercial real estate investment opportunities with a highly experienced team in multifamily real estate brokerage, acquisitions, asset management, and property management.

Investment Partnership

Real estate syndications are investment opportunities that bring together many investors to purchase assets, often managed by an experienced partner. Pilot Capital serves as the partner and operator for its syndicated deals, taking on the research, financing, and management of the assets. By pooling money from many investors, we are able to buy bigger deals with better economies of scale.

Our goal is to preserve and grow hard-earned money, and we find that’s best done by diversifying, which is what syndications allow our investors to do.

After more than 15 years working in multifamily real estate and syndicating deals, we have only become more passionate about syndication! We firmly believe that real estate syndications have the power to unlock value and generate attractive, passive returns for our investors. Our syndication model also allows us to offer our clients greater diversification across various geographies.

Maximize Your Opportunities

By pooling resources and expertise, our investors can undertake larger and more complex projects than would be feasible on an individual basis.

Instead of spending $1,000,000 on a single property, investors can break up their investment across multiple deals, taking advantage of different timelines and exit horizons, geographies and markets, and different strategies.

Benefits

Investing with us is different

We pride ourselves on our relationships, built on trust and communication. We meet investors where they are – no matter the level of experience or available capital. We keep investors informed at every stage of the process, with regular updates and detailed reporting on performance and progress towards goals. We also offer clients access to a dedicated investor portal, where they can track their investments and manage their preferences.

Benefits

Why invest in a syndication?

The current environment has made solo real estate investments much harder than previous decades, and more investors are looking at alternative ways to invest in real estate. What happened?

Real estate is more expensive

What you can buy as an individual today is quite different from previous decades and smaller buildings come with fewer economies of scale.

Financing is stricter and more restrictive

This is especially true for individual purchasers. Lenders have made commercial financing less accessible, particularly to inexperienced operators.

Managing a property is more complicated

Managing a property has become more challenging due to constantly changing landlord-tenant laws, difficulty in finding affordable vendors and reliable contractors, and attracting quality tenants, making building management more time-consuming and less enjoyable for investors.

Getting started is a lot of work

Getting into commercial real estate is a daunting task! For every investor we know that owns their own properties, we have met at least 10 more who want to invest in real estate but either don’t know where to start or have trouble taking the leap.

Benefits

Advantages of Multifamily

Multifamily properties offer a unique combination of stable income, efficiency, value-add opportunities, and diversification, making them an attractive investment opportunity for many investors

Stable, recurring income

Residential rental income is more consistent, as people will always need a place to live. Unlike other asset classes, such as retail or office space, multifamily properties are less susceptible to economic downturns.

Economies of scale

By having multiple units in one building or complex, property managers can more efficiently handle maintenance, repairs, and other ongoing expenses, which can result in higher returns for investors. This makes the property more efficient to manage than other asset types.

Potential for value-add opportunities

Underperforming or dated buildings can be optimized and renovated to increase rental income and property value.

Greater diversification

With multiple units in one building or complex, investors can spread their risk across multiple tenants, reducing the impact of any one vacancy or default. This allows for greater diversification than in other types of assets

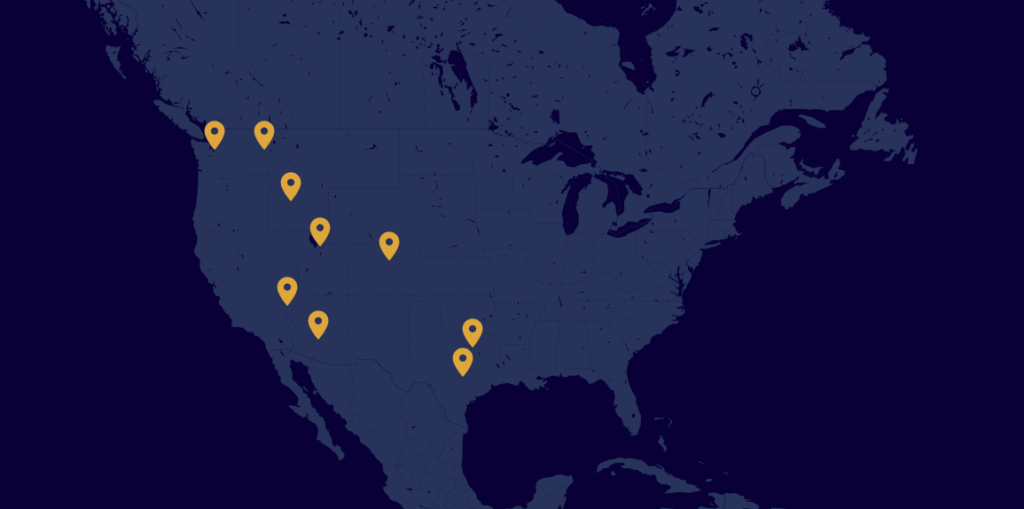

Where we look to invest

We use a data-driven approach to conduct thorough market research that ensures each investment opportunity meets our high standards for quality and potential return. Additionally, we leverage our network of industry relationships to identify deals and gain a competitive edge. We have identified specific strong-performing markets across the Sun Belt, Mountain West, and Pacific Northwest that meet our strict criteria for attractive deals. We pursue value-add assets that provide stable cash flow, allow for capital appreciation and tax benefits, while maintaining a conservative underwriting approach.

OUR CRITERIA

How we identify investment opportunities

01.

High job growth submarkets with higher-than-average population or household formation

02.

Class A/B assets with excellent opportunities for value creation through improvements while providing strong, stabilized cash flow

03.

B or better neighborhoods with strong demographics

04.

Landlord-friendly markets and submarkets

05.

Under performing or distressed multifamily properties

06.

25+ unit assets

07.

$2 million to $10 million total capitalization per property

08.

1970s and newer vintage

Stats

Track Record

Stay in the loop

Be the first to know about new and upcoming opportunities by signing up for our newsletter.